You can find out about your E and a bunch of other relevant stuff at the British German Association website. Who must complete a US Tax Return? Is this page useful? Skip to main content. You may wonder what will happen to your unemployment claim in this situation. Any data collected is anonymised. The claim about unemployment and under what circumstances you are eligible, and what you need to do, can be best described by an example.

| Uploader: | Mazunris |

| Date Added: | 3 November 2006 |

| File Size: | 64.49 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 18665 |

| Price: | Free* [*Free Regsitration Required] |

International Movers Compare up to 5 quotes from our network of moving companies that can help you plan your international yk and relocate your entire family. I searched for E and got these threads so maybe the answer is in there somewhere.

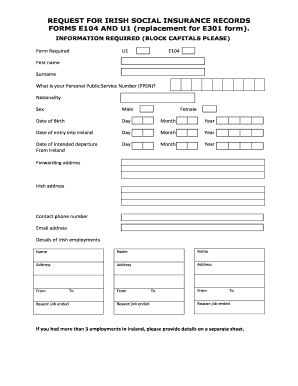

Posted 25 Aug The E, the E and E are three documents that attest to the payment of unemployment insurance contributions, health and retirement in the country of the European Union from your last residence. Claim online sign in using Government Gateway https: What are the dole in England after e01 France? I was in Italy and have not. Is this page useful?

Posted 19 Nov Find more expat blogs with BlogExpat.

Get your Income Tax right if you're leaving the UK

To help us improve GOV. Special rules for self-employed schemes When you move to another EU country, it is it is recommended to contact the competent institution to receive the correct information whenever needed, as not all EU countries have a specific self-employed scheme. From a quick Google search: Do I still need to fill a tax form if I become a British Citizen? This is taken into account while awarding you unemployment benefits.

There's nothing much e031 the forum about E yet though.

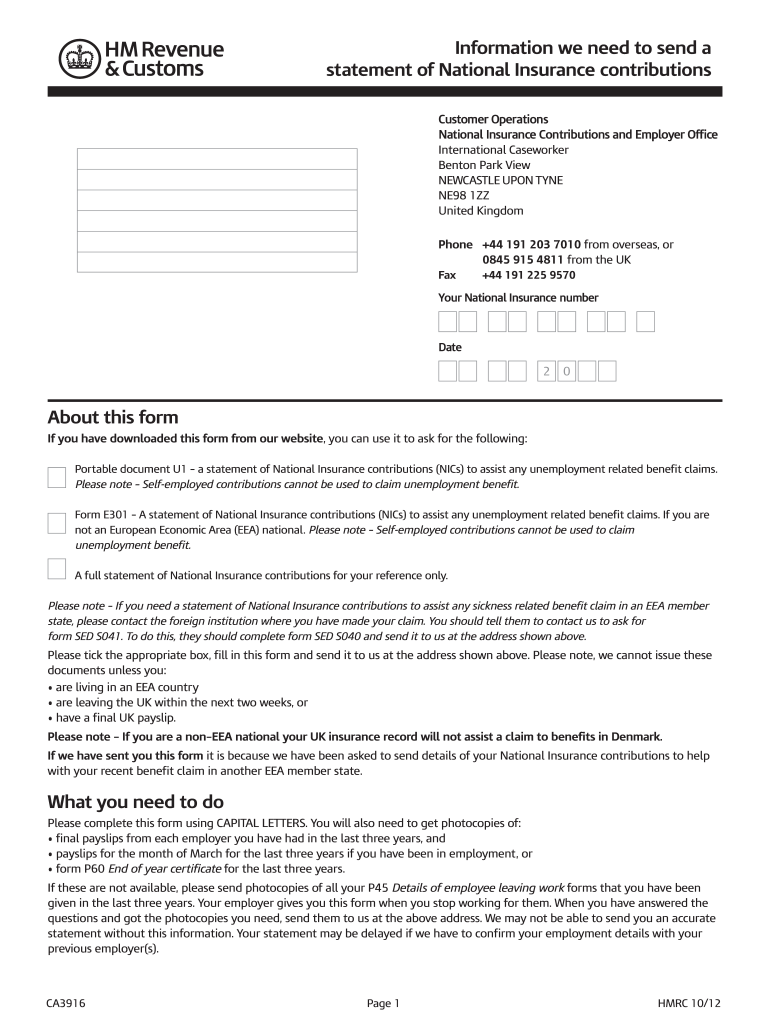

Sign in Already have an account? As such you claim unemployment benefit in the UK. I applied for it using the CA form http: You can ask details, information and post comments on the forums.

Get a statement of your National Insurance contributions

Under such a situation, you will receive a form U2 which enables you to receive unemployment benefit in the country you are moving for a certain period of time. Example in the UK: When you lay claim to unemployment benefit under such circumstances, you have to present your U1 Form to the employment service. This form can be obtained from the employment service or social security institution you are currently insured with for unemployment benefits.

What is an Umbrella Company? To use the online vorm, you need a Government Gateway user ID and password.

U1 Form HMRC - Where and When to obtain U1 Form? | DNS Accountants

Sign up to our newsletter Tax news for contractors freelancers and small businesses. What were you doing? This was however stating that they do not issue this document to individuals in accordance with EU Social Security legislation.

I'm sorry there isn't a heading that says "Specifically for Louise", but I guess those governemnt boffins are too busy trying to figure out how to beat Johnny Foreigner into a cocked hat. I have some questions regarding the E and E forms, do I have to complete both forms if any? I am a professional independent insurance broker and authorised advertiser.

Developer, Manager, Web in Amsterdam: Just saying this to avoid major big and nasty surprise for you if you find yourself later back-charged huges amounts of money from German health insurances, be they public or private - the law is quite clear on that!

The same rule applies if you have become unemployed in your own country after working in some other country and claim unemployment benefit. To get them in UK, just fill out a form ca you can download by clicking on the site of Inland Revenue.

How do I apply for a social security number in the USA?

Комментариев нет:

Отправить комментарий